Understanding The Pelosi Act: A Push For Transparency In Congress

Detail Author:

- Name : Hollie Predovic

- Username : lila.ruecker

- Email : wziemann@mcclure.com

- Birthdate : 1977-10-11

- Address : 357 Yundt Drive Roxanneborough, MD 55490

- Phone : 1-234-803-8982

- Company : Mann Inc

- Job : Mechanical Drafter

- Bio : Labore velit harum in et voluptas sapiente. Nam eligendi dolorem fugiat suscipit. Laboriosam aspernatur ut quia quis quam.

Socials

twitter:

- url : https://twitter.com/anastasia_vonrueden

- username : anastasia_vonrueden

- bio : Vel quis corrupti cupiditate quia natus totam. Qui natus ut optio doloremque sint voluptas laborum.

- followers : 2054

- following : 1468

facebook:

- url : https://facebook.com/vonruedena

- username : vonruedena

- bio : Qui odio omnis esse eos dicta dicta quo. Non sint cum veritatis minima aut.

- followers : 1234

- following : 197

tiktok:

- url : https://tiktok.com/@anastasia5938

- username : anastasia5938

- bio : Dolore quia tenetur tempore quis voluptate.

- followers : 5128

- following : 2800

instagram:

- url : https://instagram.com/anastasia8567

- username : anastasia8567

- bio : Reprehenderit perspiciatis hic veritatis consequatur quia. Placeat in architecto nihil esse sed.

- followers : 4505

- following : 2259

Have you ever wondered about the rules that guide our elected leaders, especially when it comes to their personal finances? It's a question many folks ask, and a very good one, too. The idea of public service often comes with expectations of integrity, and that, you know, includes how politicians manage their money while they're in office. This is where something called the Preventing Elected Leaders from Owning Securities and Investments Act, or the Pelosi Act for short, comes into the picture. It's a bill that aims to change how members of Congress, and their spouses, deal with stocks and other investments, truly.

The conversation around this particular piece of legislation has been going on for a while, really. It touches on concerns many people share about fairness and whether those making laws might have, perhaps, an unfair advantage when it comes to financial markets. There's a lot of talk about ensuring that our representatives are always working for the public good, without any perceived conflicts of interest. So, this bill is, in a way, a direct response to those kinds of worries, seeking to put clearer boundaries in place.

This measure, which has certainly garnered a lot of attention, proposes some rather significant changes to how things have been done. It's about drawing a line, you might say, between public duty and private financial dealings, especially when those dealings involve individual company stocks. The whole point is to try and make sure that there's no question about legislative integrity, which is, you know, pretty important for public trust.

Table of Contents

- What Exactly is the Pelosi Act?

- Why the Name? The Origin of the Pelosi Act's Designation

- The Journey Through the Legislative Process

- Key Provisions and What They Mean

- Bipartisan Voices on the Measure

- Frequently Asked Questions About the Pelosi Act

What Exactly is the Pelosi Act?

The Preventing Elected Leaders from Owning Securities and Investments Act, or the Pelosi Act, as it's often called, is a proposed law that aims to really tighten up the rules around financial holdings for members of Congress. Basically, it wants to stop lawmakers and their spouses from owning or trading individual stocks and some other financial instruments while they're serving the public. This is a big step, as it's almost a complete shift from how things have been handled in the past, you know.

The core idea behind this bill is to ban lawmakers and their spouses from purchasing, selling, or even holding individual stocks for the duration of the lawmaker’s time in office. This means no more picking and choosing specific company shares. It's a very straightforward concept, really, designed to remove any appearance of insider advantage, which is a concern many people have expressed.

This bill is meant to prevent any potential conflicts of interest that might arise if elected officials are trading stocks in industries they regulate or influence. It's about ensuring that decisions made in Congress are made purely for the public good, without any thought of personal financial gain. So, it's a pretty significant proposal, aiming for a higher level of ethical conduct, some might say.

The measure, in its full form, the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act, would prohibit members of Congress and their spouses from trading or holding these kinds of investments. It's a pretty broad prohibition, designed to cover a wide range of financial activities. This is, you know, a way to build more trust in the legislative body.

It's important to remember that this bill is not about stopping all investments. Rather, it specifically targets individual stocks and related financial instruments. It does, however, allow for diversified investment funds or U.S. Treasury bonds. This distinction is quite important, as it means lawmakers can still save and invest for their future, just not in a way that could be seen as directly benefiting from their legislative work, which is, you know, a fair point.

Why the Name? The Origin of the Pelosi Act's Designation

You might be wondering why this particular bill carries the name "Pelosi Act." It's actually named after former House Speaker Nancy Pelosi, and there's a specific reason for that. Her husband, Paul Pelosi, faced a fair bit of scrutiny over some significant stock trades he made, which, you know, really brought the issue of congressional stock trading into the public eye in a big way.

One particularly notable transaction involved semiconductor stocks. This happened shortly before certain legislative actions related to the semiconductor industry, which, understandably, raised some eyebrows. President Donald Trump, for instance, even said that former House Speaker Nancy Pelosi should be investigated for insider trading, which, in a way, put a spotlight on the whole issue. This kind of public discussion, you know, really fueled the push for new rules.

The attention surrounding these trades, and the broader concern about lawmakers potentially benefiting from information they gain in their official capacity, led to calls for greater transparency and stricter rules. So, the bill being named the Pelosi Act is, in essence, a direct reference to these past events and the public conversation they sparked. It’s a pretty clear indicator of the concerns it aims to address, you might say.

It's not uncommon for bills to be named, informally or formally, after events or individuals that highlight the need for such legislation. In this case, the scrutiny around Paul Pelosi's trades became a symbol for the broader issue of congressional stock trading, making the name a kind of shorthand for the problem the bill seeks to solve. It's, you know, a very direct connection.

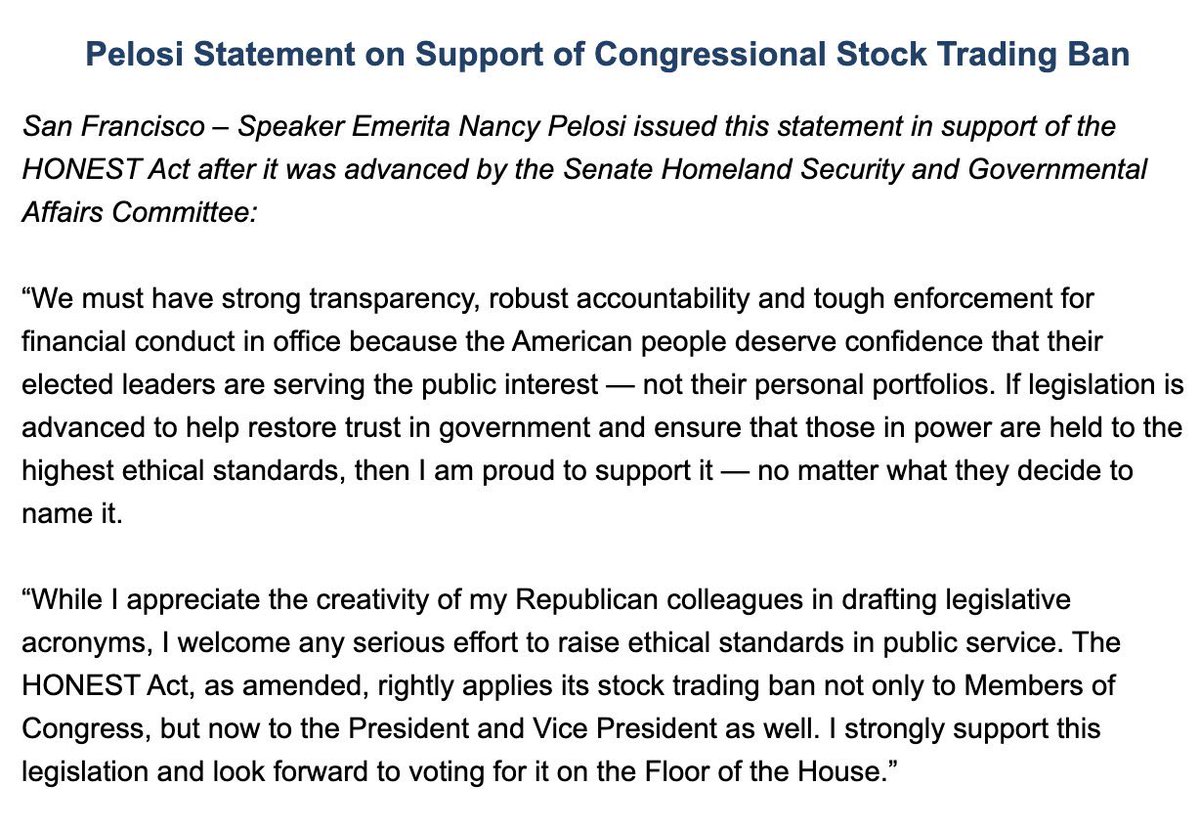

Even Nancy Pelosi herself, in response to the scrutiny, has indicated support for a bill that would ban stock trading by members of Congress. This shows that the issue has indeed resonated across the political spectrum, leading to a broader agreement that something needs to be done about it. So, the name, in a way, represents a significant moment in this ongoing discussion.

The Journey Through the Legislative Process

The Pelosi Act, or rather, the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act, has been on a bit of a journey through the legislative halls. Senator Josh Hawley, for instance, reintroduced the Pelosi Act to ban lawmakers and their spouses from trading individual stocks while in office. He cited bipartisan concerns over insider advantage, which, you know, really highlights the widespread nature of this issue.

A version of this bill, actually called the Preventing Elected Leaders from Owning Securities and Investments, or PELOSI Act, as an acronym, was voted out of a Senate committee. This is a pretty significant step in the legislative process, showing that it has gained some traction and support among lawmakers. It's not an easy thing to get a bill through committee, so this was, you know, a notable achievement.

The Homeland Security and Governmental Affairs Committee, specifically, has just passed out of committee the Pelosi Act. This version aims to ban stock trading among those in Congress, as well as the President and Vice President. So, it's not just about congressional members anymore, but also the very top elected officials, which is, you know, an expansion of its scope.

Interestingly, while Senator Hawley originally introduced the Pelosi Act earlier this year, what ultimately passed through the dizzying committee markup process on a recent Wednesday was actually called the HONEST Act. This shows how bills can sometimes evolve and even change names as they move through different stages of debate and revision in Congress. It's a pretty common occurrence, really, in the legislative world.

The fact that a version of this bill has made it out of committee suggests there's a growing consensus, or at least a strong desire, to address the issue of congressional stock trading. It indicates that lawmakers are feeling the pressure to act on this matter, which, you know, is a good sign for those hoping for more transparency.

Congressional stock trading ban gets Senate panel’s okay, and it seems Democrats agreed to exempt President Donald Trump to advance GOP Senator Hawley's bill. This kind of compromise is, you know, often necessary to move legislation forward, even when there are differing views on specific details. It shows that there's a willingness to work across the aisle on this particular issue, which is, in a way, encouraging.

Key Provisions and What They Mean

The Pelosi Act, at its heart, is about preventing elected leaders from owning securities and investments in a way that could create conflicts. The bill specifically prohibits members of Congress (or their spouses) from holding or trading certain investments. This is a pretty clear directive, aimed at removing any ambiguity, you know.

For instance, it targets individual stocks and related financial instruments. This means no direct investments in specific companies. The thinking here is that if a lawmaker owns stock in a company, they might be influenced by that ownership when making decisions about laws or regulations that affect that company. It's a very direct attempt to remove that potential influence, which is, you know, a fair concern.

However, the bill does make some allowances. It specifically exempts diversified investment funds or U.S. Treasury bonds. This is an important distinction. It means lawmakers can still invest their money, but they have to do so in broad, diversified funds where their personal financial interests are not tied to the performance of a single company or industry. This is, you know, a practical approach to the issue.

Another key provision deals with when these rules would apply. For any member of Congress who commences service as a member of Congress after the date of enactment of the Preventing Elected Leaders from Owning Securities and Investments (PELOSI) Act, they would have 180 days after the first date of their initial term of service to comply. This gives them a transition period, which is, you know, a reasonable thing to do.

The act bans lawmakers and their spouses from holding, purchasing, or selling individual stocks while serving in their elected roles. This is a comprehensive ban on direct stock ownership for the duration of their time in office. It's a pretty strong stance, aiming to eliminate any appearance of impropriety, which is, you know, a significant goal.

The bill also proposes to amend the Ethics in Government Act of 1978. This suggests that it's building upon existing ethical frameworks, strengthening them to address modern concerns about financial conflicts. It's not just creating new rules out of thin air, but rather, you know, updating and improving what's already there.

A bill to amend chapter 131 of title 5, United States Code, to prohibit transactions involving certain financial instruments by members of Congress, is what this essentially is. This legal language points to the seriousness of the proposal and how it aims to codify these new ethical standards into law. It's a very formal way of making sure these rules are clear and enforceable, which is, you know, pretty important.

Bipartisan Voices on the Measure

It's quite interesting to see that the Pelosi Act has gained support from both parties. This isn't always the case with legislation, so it really speaks to the widespread concern about congressional stock trading. You know, when you have both Democrats and Republicans agreeing on an issue, it often means it's something that truly resonates with the public.

For instance, the bill, named after Nancy Pelosi, has gained support from both parties, including Donald Trump and Hakeem Jeffries. This is a pretty diverse group of political figures, showing that the issue of legislative integrity and avoiding insider advantage crosses traditional party lines. It's, you know, a clear indication of a shared goal.

President Donald Trump said recently that former House Speaker Nancy Pelosi should be investigated for insider trading, prompting Pelosi to say she backs a bill that would ban stock trading by members of Congress. This exchange, in a way, highlights how the issue has become a point of agreement, even if the initial motivations might differ. It's, you know, a sign of common ground.

Senator Josh Hawley, a Republican, reintroduced the Pelosi Act, citing bipartisan concerns over insider advantage. This reiterates the point that the problem isn't seen as belonging to one party or another. Rather, it's a concern about the integrity of the entire legislative body, which is, you know, a very important principle.

The ongoing scrutiny of congressional stock trading has really put pressure on lawmakers to act. When the public sees perceived conflicts of interest, it can erode trust in government. So, a bill like the Pelosi Act, with its bipartisan backing, is, in a way, an attempt to restore and strengthen that trust. It's, you know, a response to a widely felt concern.

The fact that this measure has moved forward in the Senate with support from across the aisle suggests that there's a real appetite for change in this area. It's not just a fringe idea; it's something that a significant number of lawmakers, from different political backgrounds, believe is necessary. This is, you know, a powerful message about the seriousness of the issue.

Frequently Asked Questions About the Pelosi Act

What types of investments would the Pelosi Act prohibit for members of Congress?

The Pelosi Act would specifically prohibit members of Congress and their spouses from holding, purchasing, or selling individual stocks. This means they couldn't directly invest in specific companies. It's a pretty clear restriction, aimed at preventing any direct financial ties to particular businesses that might be affected by legislation. However, it does allow for diversified investment funds or U.S. Treasury bonds, so they can still save and invest, just not in a way that could be seen as having a direct personal stake in individual company performance, which is, you know, a very important distinction.

Who introduced the Pelosi Act and what was its original name?

The Pelosi Act was reintroduced by Senator Josh Hawley. Its original, more formal name is the Preventing Elected Leaders from Owning Securities and Investments Act. The "Pelosi Act" is actually an acronym for this longer title, PELOSI, which also, you know, happens to be named after former Speaker Nancy Pelosi due to the public scrutiny surrounding her husband's stock trades. So, it has both a formal and an informal, yet very descriptive, name, which is, you know, quite interesting.

Has the Pelosi Act passed through any committees in Congress?

Yes, a version of the Preventing Elected Leaders from Owning Securities and Investments, or Pelosi Act, as an acronym, was indeed voted out of a Senate committee. Specifically, the Homeland Security and Governmental Affairs Committee has passed it out. While Senator Hawley originally introduced the Pelosi Act, what ultimately passed through the committee markup process was called the HONEST Act. This shows that the core idea has gained traction and moved forward in the legislative process, which is, you know, a pretty big step for any bill.

Learn more about congressional ethics on our site, and link to this page public trust in government.